All Categories

Featured

Table of Contents

- – What is the best Iul Financial Security option?

- – Is there a budget-friendly Indexed Universal L...

- – Who has the best customer service for Long-te...

- – What does Iul Protection Plan cover?

- – Why is Iul Account Value important?

- – What is the most popular Iul Policy plan in ...

- – What should I know before getting Indexed Un...

In case of a gap, superior plan car loans in unwanted of unrecovered expense basis will certainly be subject to ordinary income tax obligation. If a policy is a customized endowment contract (MEC), plan finances and withdrawals will be taxable as regular revenue to the degree there are revenues in the policy.

It's vital to keep in mind that with an outside index, your policy does not directly get involved in any type of equity or fixed earnings financial investments you are not buying shares in an index. The indexes offered within the policy are constructed to keep track of varied segments of the U.S

What is the best Iul Financial Security option?

An index may affect your rate of interest credited, you can not buy, directly get involved in or obtain reward payments from any of them with the plan Although an exterior market index may affect your passion attributed, your policy does not directly take part in any supply or equity or bond financial investments. IUL companies.

This content does not apply in the state of New York. Assurances are backed by the monetary toughness and claims-paying ability of Allianz Life insurance policy Business of The United States And Canada. Products are issued by Allianz Life insurance policy Business of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Secure your liked ones and conserve for retirement at the same time with Indexed Universal Life Insurance Policy. (IUL plans)

Is there a budget-friendly Indexed Universal Life Premium Options option?

HNW index global life insurance policy can aid build up cash value on a tax-deferred basis, which can be accessed during retirement to supplement income. (17%): Policyholders can typically borrow against the cash value of their plan. This can be a source of funds for various needs, such as investing in a service or covering unexpected expenditures.

The survivor benefit can assist cover the expenses of finding and training a replacement. (12%): In many cases, the cash worth and survivor benefit of these policies might be protected from financial institutions. This can give an additional layer of financial protection. Life insurance policy can additionally assist lower the threat of an investment portfolio.

Who has the best customer service for Long-term Iul Benefits?

(11%): These plans provide the potential to make rate of interest connected to the performance of a securities market index, while likewise offering a guaranteed minimum return (IUL protection plan). This can be an appealing alternative for those looking for development possibility with downside security. Resources forever Research Study 30th September 2024 IUL Survey 271 respondents over 30 days Indexed Universal Life Insurance Coverage (IUL) may appear complicated originally, yet comprehending its mechanics is essential to comprehending its complete possibility for your monetary preparation

If the index gains 11% and your engagement price is 100%, your cash money value would be credited with 11% passion. It is very important to keep in mind that the optimum rate of interest credited in a given year is topped. Allow's say your picked index for your IUL plan gained 6% initially of June to the end of June.

The resulting passion is included in the money value. Some policies calculate the index gains as the amount of the modifications for the period, while various other plans take a standard of the day-to-day gains for a month. No interest is credited to the cash account if the index decreases rather than up.

What does Iul Protection Plan cover?

The rate is established by the insurance policy firm and can be anywhere from 25% to even more than 100%. IUL policies generally have a flooring, typically established at 0%, which safeguards your money worth from losses if the market index performs adversely.

The rate of interest credited to your cash money value is based on the performance of the chosen market index. The part of the index's return attributed to your cash money worth is figured out by the participation rate, which can differ and be adjusted by the insurance policy company.

Shop about and compare quotes from various insurance provider to discover the very best policy for your needs. Very carefully review the plan images and all terms and conditions prior to deciding. IUL includes some degree of market risk. Prior to picking this type of plan, ensure you're comfortable with the potential changes in your cash value.

Why is Iul Account Value important?

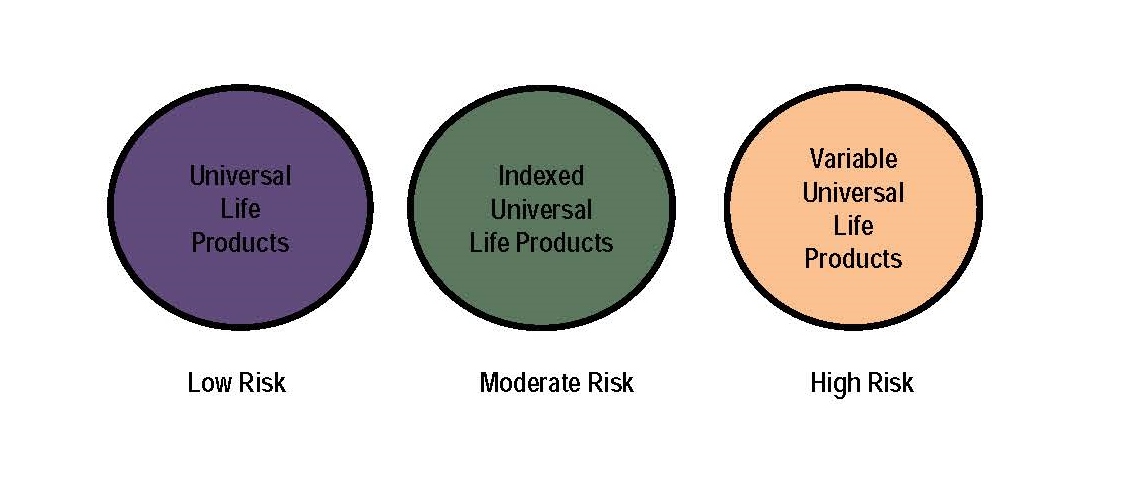

Comparative, IUL's market-linked cash value growth supplies the potential for higher returns, specifically in good market problems. This possibility comes with the risk that the supply market efficiency may not provide continually steady returns. IUL's versatile costs settlements and flexible death benefits offer versatility, appealing to those looking for a policy that can advance with their changing economic scenarios.

Indexed Universal Life Insurance Policy (IUL) and Term Life Insurance are various life plans. Term Life Insurance coverage covers a specific duration, typically in between 5 and 50 years.

It appropriates for those looking for temporary security to cover certain economic commitments like a home mortgage or children's education and learning fees or for service cover like shareholder protection. Indexed Universal Life (IUL), on the various other hand, is an irreversible life insurance coverage plan that offers insurance coverage for your entire life. It is much more pricey than a Term Life policy due to the fact that it is made to last all your life and supply an ensured money payment on death.

What is the most popular Iul Policy plan in 2024?

Selecting the appropriate Indexed Universal Life (IUL) plan has to do with finding one that lines up with your financial goals and run the risk of tolerance. A knowledgeable monetary expert can be vital in this process, leading you through the complexities and ensuring your chosen policy is the right fit for you. As you investigate purchasing an IUL policy, keep these essential factors to consider in mind: Recognize exactly how attributed rates of interest are connected to market index efficiency.

As outlined earlier, IUL plans have various fees. A greater rate can boost possible, however when contrasting policies, evaluate the cash money worth column, which will certainly help you see whether a higher cap rate is better.

What should I know before getting Indexed Universal Life Tax Benefits?

Research the insurance firm's economic ratings from firms like A.M. Best, Moody's, and Standard & Poor's. Various insurance providers provide variants of IUL. Job with your advisor to comprehend and find the very best fit. The indices connected to your plan will directly affect its efficiency. Does the insurance company supply a selection of indices that you desire to align with your investment and danger profile? Versatility is crucial, and your policy should adjust.

Table of Contents

- – What is the best Iul Financial Security option?

- – Is there a budget-friendly Indexed Universal L...

- – Who has the best customer service for Long-te...

- – What does Iul Protection Plan cover?

- – Why is Iul Account Value important?

- – What is the most popular Iul Policy plan in ...

- – What should I know before getting Indexed Un...

Latest Posts

Wrl Index Universal Life Insurance

Index Life Insurance Vs Roth Ira

Universal Reinsurance System

More

Latest Posts

Wrl Index Universal Life Insurance

Index Life Insurance Vs Roth Ira

Universal Reinsurance System